In the world of managing money, knowing and handling your credit score is super important for your financial health. Checking your credit score isn’t something you do just once; it’s like taking care of your money’s health regularly, and it can really affect your financial path.

Luckily, in today’s digital world, keeping an eye on your credit score is easier than ever. There are lots of free apps that make sure you have this important info right on your phone whenever you need it.

In this article, we’ll break down the complexities of credit scores in simple terms, helping you understand why they matter. We’ll also introduce you to a few user-friendly apps that not only demystify your credit score but also offer valuable insights and tips to boost it.

Table of Contents

Why Check Your Credit Score Regularly?

Before we dive into the world of credit score apps, let’s take a moment to understand why regular check-ups on your credit health are essential. Your credit score is not just a number; it’s a key determinant for lenders when assessing your eligibility for loans, credit cards, and favorable interest rates.

A healthy credit score can unlock doors to better financial opportunities, while a neglected one might lead to higher interest rates or even loan rejections.

Moreover, consistent monitoring of your credit score allows you to spot errors or unauthorized activities early on. Identity theft and reporting errors can have a significant impact on your creditworthiness, and catching them promptly can save you from potential headaches down the road.

Building and maintaining good credit is a journey, not a destination. Regularly checking your credit score is akin to a health check-up for your finances, helping you make informed decisions and ensuring that you are on the right track.

Criteria for Selecting Credit Score Apps:

Not all credit score apps are created equal. When selecting an app to monitor your credit score, consider the following criteria:

Accuracy of Credit Score Reporting

The primary function of these apps is to provide an accurate representation of your creditworthiness. Look for apps that pull data from reputable credit bureaus(e.g: CIBIL, Experian) to ensure the information is reliable and up-to-date.

Frequency of Score Updates

The financial landscape is dynamic, and so is your credit score. Opt for apps that offer frequent updates, allowing you to stay in the loop with any changes to your credit profile.

User-Friendly Interface

A good credit score app should present information in a clear and understandable manner. A user-friendly interface enhances the overall experience and makes it easier for you to navigate through your financial data.

Additional Features

While the core function is to check your credit score, many apps go above and beyond by offering additional features. These can include credit monitoring, personalized financial tips, and insights to help you improve your credit score.

Now, let’s explore some of the best free apps that meet these criteria and empower you on your financial journey.

Top Free Apps to Check Your Credit Score:

In this section, we will be discussing apps that can help you monitor your credit reports for free, and also they can help you in providing an instant personal loan whenever you need it.

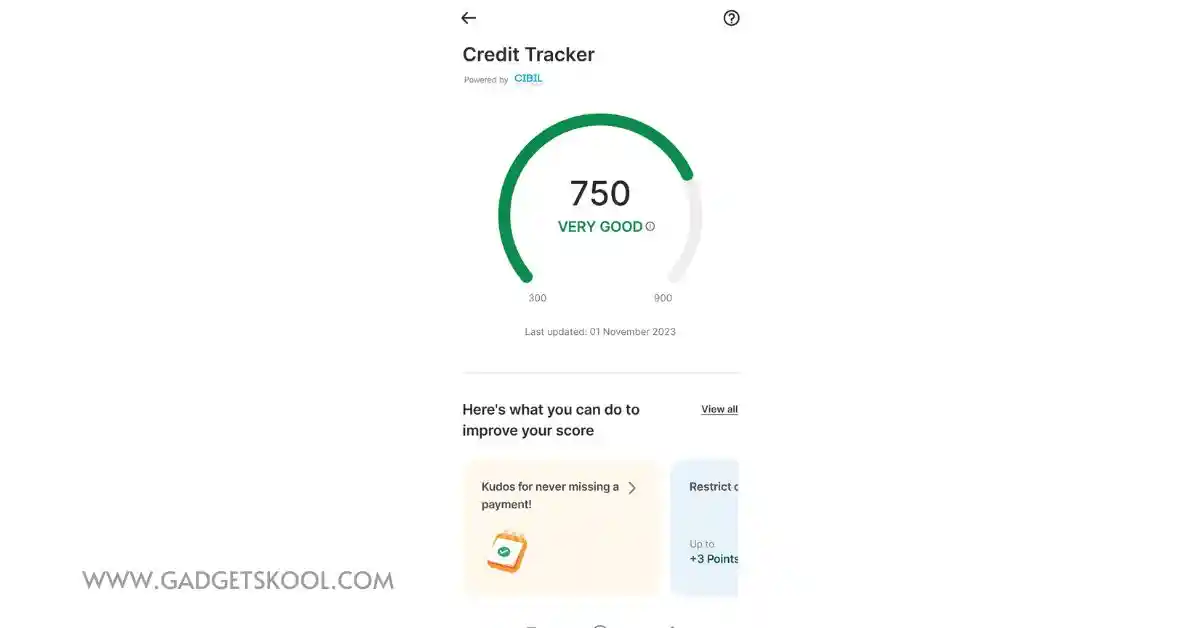

1. GPay(Google Pay)

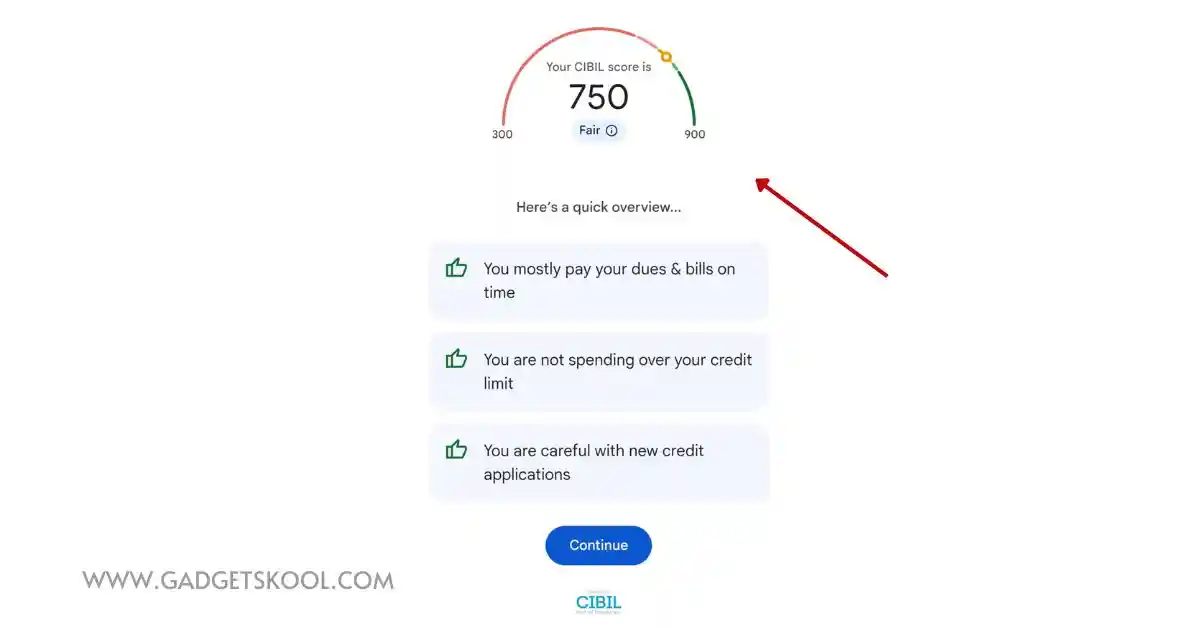

GPay stands out as a frontrunner in the realm of free credit score monitoring. Offering not just a snapshot of your credit score but a comprehensive view of your credit report, including credit cards and other loan details to provide insights into the factors influencing your score.

Features and Benefits:

- Credit Monitoring: Receive alerts for significant changes to your credit report.

- Credit Factors Analysis: Understand the factors impacting your score and receive tailored recommendations.

- Credit Simulator: Simulate how financial decisions might affect your credit before making them.

- UPI & Bill Payments: By using GPay, you are not just limited to credit reporting, there are various other options for UPI, bill payments, and personal loan offers.

User Interface and Experience:

GPay’s simple & intuitive user interface makes it easy to navigate through your credit profile. The app’s user-friendly design ensures that even those unfamiliar with financial jargon can comprehend their credit health effortlessly.

Unique Features:

GPay’s unique offerings include a free credit score simulator that lets you explore hypothetical scenarios affecting your credit.

Check your credit score on GPay

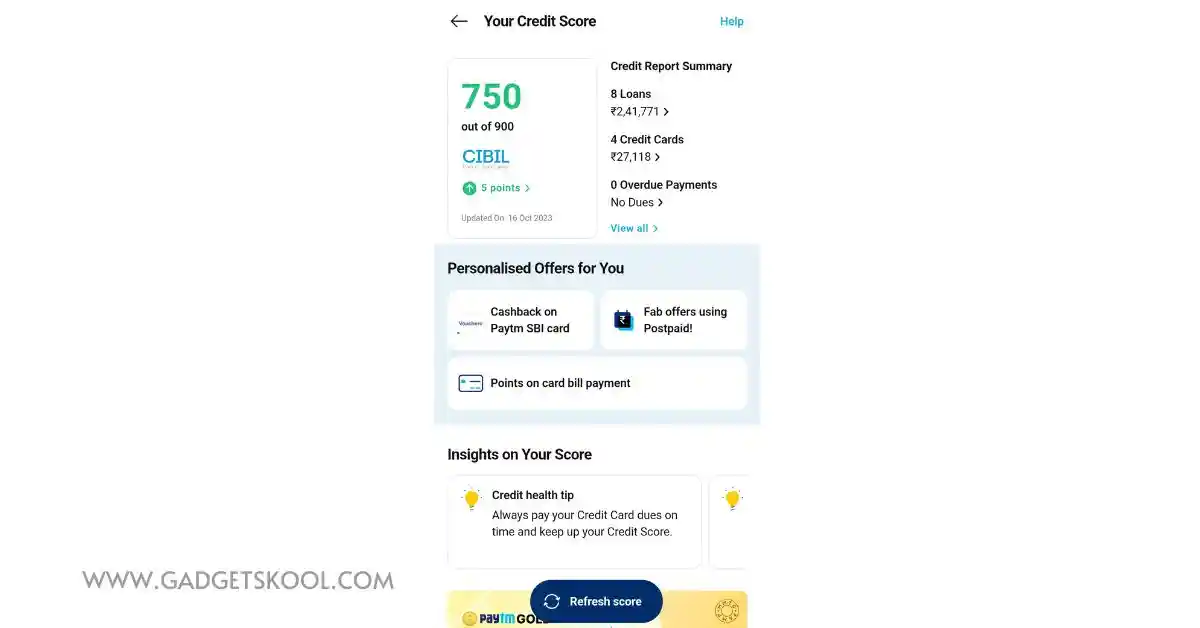

2. Paytm

Paytm is India’s first wallet-based mobile payment application where you can pay your bills, recharge your mobile, invest in mutual funds/golds, and check your credit score for free.

Features and Benefits:

- Free Credit Score Monitoring: Regular updates on your credit score and reports(monthly refresh).

- Loan and Credit Card Recommendations: Get personalized suggestions for loans and credit cards.

- Paytm Postpaid: A BNPL service that helps you recharge or pay your monthly bills.

- Payments and Transactions: Users can make payments for utility bills, mobile recharges, and DTH services, and book flights and train tickets through the app.

User Interface and Experience:

Paytm’s mobile app interface may look like something cluttering for first-time users, but the app provides a seamless experience across various services as a hybrid app. Once a user is familiar with the app and the UI, it becomes easy for them to navigate further for different services.

Unique Features:

Paytm provides a 360 digital banking solution known as Paytm Payments Bank and other related services like loans, credit cards, insurance, and other investment options along with the credit score monitoring feature.

Check your credit score on Paytm

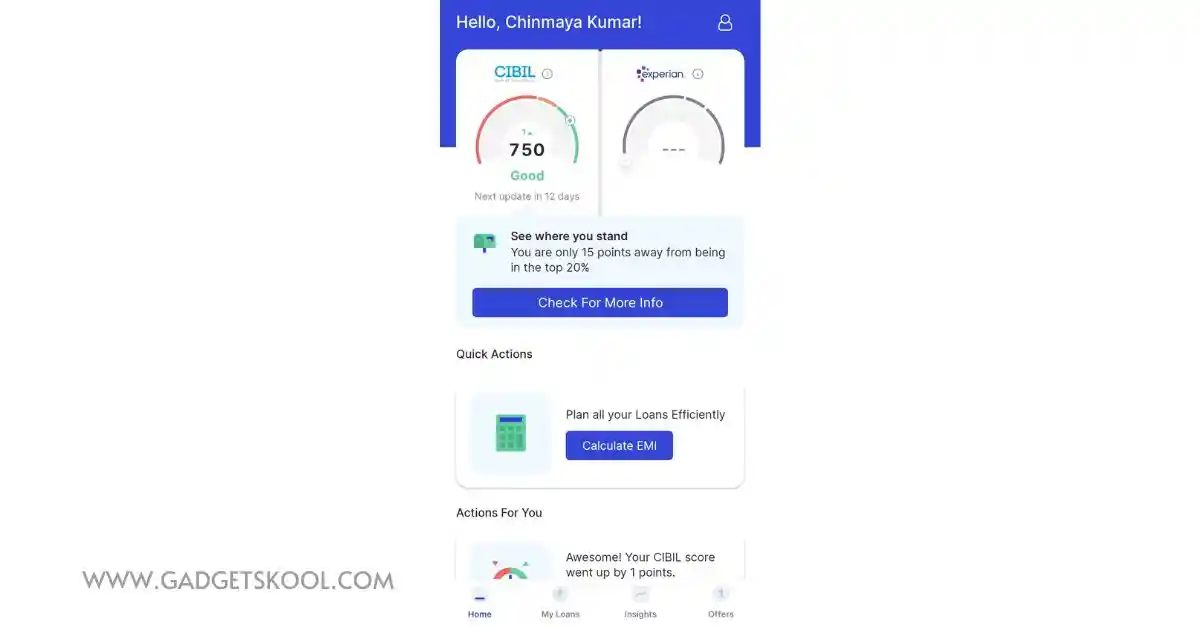

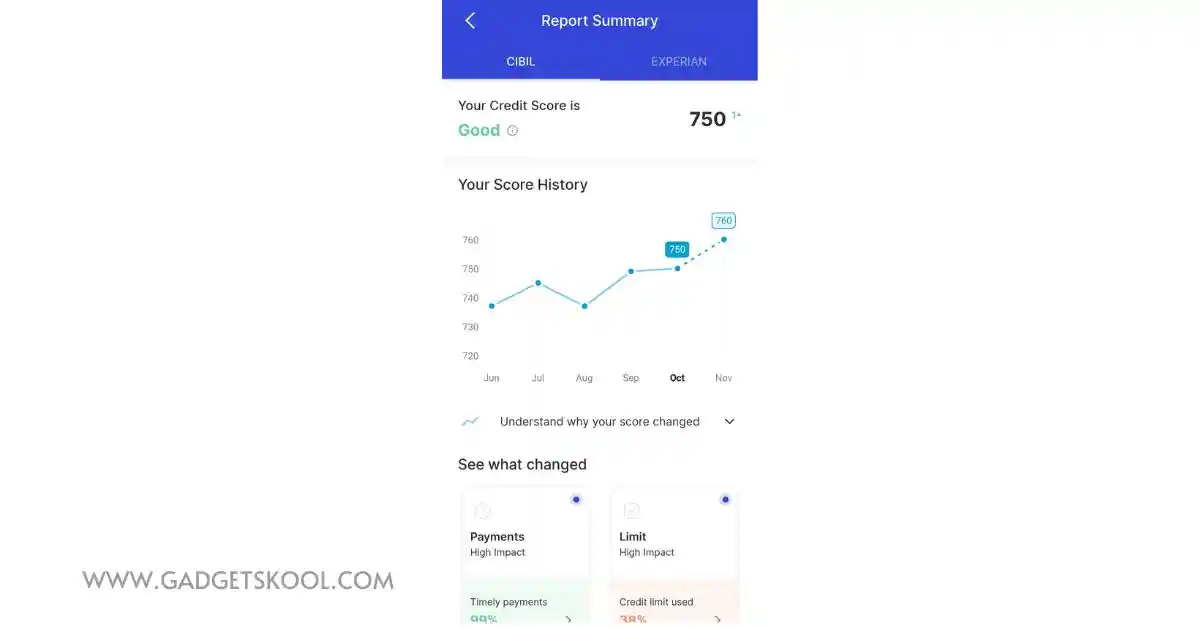

3. OneScore

OneScore is a comprehensive credit management app offering instant personal loans and free credit score insights. You can check your credit score both for Experian & CIBIL for free of cost as many times as you want.

Features and Benefits:

- Credit Score Monitoring: Provides free and instant access to both Experian and CIBIL credit scores along with real-time notifications for changes in your credit score.

- Credit Score Improvement: Analyzes your credit data with the ‘Find out why’ feature, and offers personalized insights to improve your credit score.

- Instant Personal Loan: Offers instant personal loans with flexible EMI options with no collateral and a 100% digital documentation process.

- Free Metal Credit Card: Eligible users can have access to India’s first metal credit card free of cost, with no joining & annual fees.

User Interface and Experience:

OneScore mobile app guarantees a spam-free and ad-free environment, eliminating unsolicited calls and messages. With its rich, simple, and unique interface design, you will get all your credit details at your fingertips.

The app also ensures the safety and security of user information by not sharing any data with third parties or institutions.

Unique Features:

OneScore not only provides your credit score but also offers a detailed credit report. The app’s tracking capabilities empower you to monitor changes in your credit profile over time. It also keeps you informed with credit alerts for significant changes and monitors your overall credit profile.

Check your credit score on OneScore

4. Credit Sesame

Credit Sesame is a powerful, free credit score management app designed to provide users with a comprehensive understanding of their credit health. Whether you aim to enhance your credit score, plan for a major purchase like a house, or simply want to monitor your financial well-being, Credit Sesame offers a range of features to support your goals.

Features and Benefits:

- Free Credit Score & Report Summary: Instantly obtain your TransUnion credit score and receive daily refreshes to stay informed about your credit status.

- Credit Alerts & Monitoring: Stay informed about changes to your credit file with free credit alerts and safeguard your credit score through continuous monitoring.

- Credit Builder Account: Utilize a unique feature that enables credit building through everyday debit card use provided by the company.

- Credit Tips & Offers: Access personalized insights and actionable tips to improve your credit score and secure favorable rates.

User Interface and Experience:

High user ratings reflect Credit Sesame’s effectiveness and user satisfaction. The app is praised for its simplicity and helpful recommendations.

You can access, understand, and protect your credit, all in one place.

And receive tailored actions and product suggestions based on your credit profile.

Unique Features:

Credit Sesame stands out by offering personalized financial product recommendations, and guiding users toward options that align with their financial goals.

5. Moneyview

Moneyview is one of the leading personal loan apps in India approved by RBI and backed by reputable NBFCs. The app provides easy & hassle-free personal loans for different purposes with attractive EMI offers. Apart from personal loans, you can check your detailed credit score for free by using the app.

Features and Benefits:

- Free Credit Score Report: Get your free credit report with all the necessary details by just providing your PAN & UID card details.

- Instant Personal Loan: The Moneyview app provides instant personal loans when in need with attractive EMI rates based on eligibility.

- Digital Savings Account: Experience new-age banking with the Moneyview Digital Savings Account powered by Suryoday Bank, along with a lifetime free virtual card.

User Interface and Experience:

The Moneyview app is a simple-looking mobile application, where currently not many features are introduced as of now, along with the mobile application you can check their official website for different services. The mobile app currently has limited features like personal loan, insurance, and credit score tracking features.

Unique Features:

Apart from the credit score tracking, you can get yourself an instant personal loan if eligible and avail of a digital savings account, virtual card, and other discount offers.

Also Read: Fake Personal Loan Apps You Must Avoid (Banned by Government)

Frequently Asked Questions(FAQs):

Why is my credit score important?

Your credit score influences your ability to get loans, and credit cards, with favorable interest rates. It’s one of the major key factors in financial decisions, especially in lending.

How often should I check my credit score?

Regularly monitoring your credit score is a wise decision. Many experts suggest checking it at least once a month.

Can checking my credit score lower it?

No, checking your own credit score is considered a “soft inquiry” and does not affect your score.

How is my credit score calculated?

Credit scores are calculated based on factors like payment history, credit utilization, length of credit history, types of credit, and new credit.

Do credit score apps provide accurate scores?

Yes, reputable credit score apps pull information from major credit bureaus, providing accurate scores.

Are credit score apps really free?

Yes, many credit score apps offer basic services for free. Some may provide additional paid features.

Can credit score apps help improve my credit?

While they can’t directly help you improve your score, some apps offer insights and recommendations to improve your credit score by addressing specific factors.

How often do credit scores change?

Credit scores can change monthly, depending on your financial activities and reported information.

Can I trust credit score app security?

Reputable apps use secure encryption and protocols to protect your sensitive financial information.

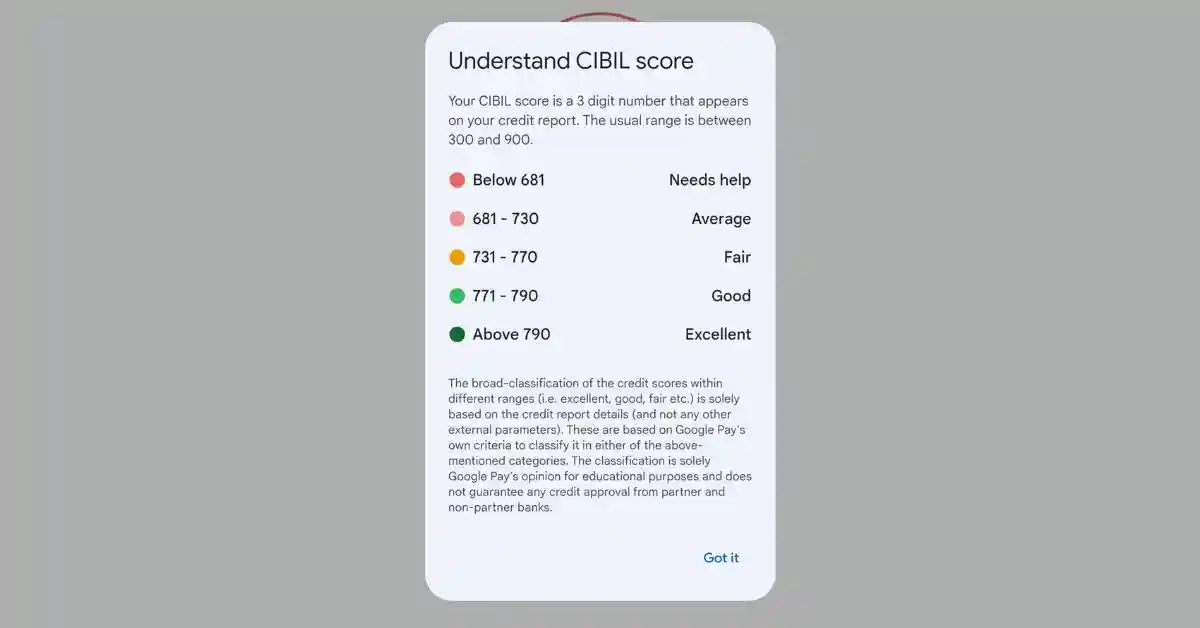

What is a good credit score range?

A CIBIL score above 750, and a FICO score above 706 is generally considered good, but specific score ranges can vary by lender.

How long does negative information stay on my credit report?

Negative information like late payments can stay on your credit report for up to seven years.

Do credit score apps offer identity theft protection?

Some credit score apps provide identity theft alerts and monitoring services.

Can I dispute errors on my credit report through these apps?

Yes, many apps allow you to dispute errors directly through the app, guiding you through the process.

Are credit score apps a substitute for professional financial advice?

While these apps offer valuable insights, consulting with a financial advisor for personalized advice is recommended.

How long does it take to see credit score improvements?

Positive changes, like paying off debt, can be reflected in your score within a few months, but significant improvements may take time.

What happens if I miss a credit card payment?

Missing a payment can negatively impact your credit score, and you may incur late fees and increased interest rates.

Can I get a mortgage with a low credit score?

While it is possible, it’s generally challenging. Higher credit scores often lead to better mortgage terms.

Do credit score apps offer educational resources?

Yes, many apps provide articles, surveys, games, and tools to enhance your understanding of credit and personal finance.

Can using multiple credit score apps harm my credit?

No, checking your credit with different apps does not harm your credit score. Each check is considered a soft inquiry.

What should I do if I find an error on my credit report through an app?

You need to immediately contact the specific credit bureau and provide documentation to dispute and correct any inaccuracies.

Final Words:

In the digital age, where every day-to-day transaction is happening online, monitoring your credit score regularly is your first responsibility.

The applications we discussed in this article empower you to take control of your credit health effortlessly. Choose an app that aligns with your preferences, and embark on a journey towards financial well-being.

Regular check-ups on your credit score today can pave the way for a brighter financial future tomorrow.

| Visit Home page: 👉 | Click Here |

| Follow us on Instagram: 👉 | Click Here |

| Subscribe on YouTube: 👉 | Click Here |

| Join our (New)Telegram Channel: 👉 | Click Here |

| Connect with us on Twitter: 👉 | Click Here |

✪ Please Bookmark our website to receive the most useful updates, regularly for free. Press (Ctrl+D) now, to Bookmark instantly. @: gadgetskool.com